Real estate has become a popular avenue for people looking to diversify their income streams and potentially hedge against inflation. Whether you’re a seasoned pro or just getting started in investing, Birmingham, AL, is certainly worth considering. In the heart of Alabama is the state’s most populous city, Birmingham. The city of Birmingham is affectionately known as The Magic City, for its substantial growth during the 20th century. This city is also the founding place of Veterans Day and is the only place in the U.S. where all of the ingredients for iron ore are naturally present within a 10-mile radius. Residents and rental property owners in Birmingham, AL, enjoy a low cost of living and a unique food scene that fits right in with the city's southern roots. There’s also an abundance of sports teams to choose from, and a plethora of sports bars and breweries for communities to gather and cheer at. But what about the Birmingham real estate market? What do stats and trends look like, especially right now? Facts and figures are constantly changing, so we’ve gathered all the most up-to-date information for you. Here are some of the top trends for January, 2024 in the Birmingham real estate market:

Birmingham General Statistics

- Population (city proper): 190,096 (down -5% since 2020)

- Population (metro area): 1,116,857

- Area (city proper): 147 sq. mi.

- Area (metro area): 4,488.7 sq. mi.

- Median Age: 35.2

- GDP Birmingham-Hoover Metro Area: 79 billion

- Unemployment rate: 2.9% (up .1% month-over-month)

- Top employers: University of Alabama - Birmingham; Regions Financial Corporation; St. Vincent’s Health System; Children's of Alabama; AT&T; Honda Manufacturing of Alabama; Brookwood Baptist Health; Jefferson County Board of Education; City of Birmingham; Mercedes Benz International, Inc.

- Highest paying jobs: Physician, Hospitalist Physician, Hematologist, Cardiologist, Internist, Medical Director, Hospitalist, Radiologist, Rheumatologist, Psychiatrist

- Median income (per capita): $29,492

- Median income (household): $39,326

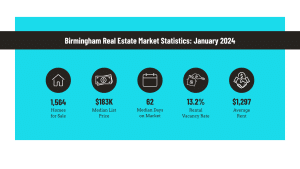

Birmingham Real Estate Market Statistics

- Neighborhoods: 88

- Homes for sale as of January,2024: 1,564

- Median list price: $183k (down 1% since November 2023)

- Median sold price: $192.5k

- Sale-to-list price ratio: 98.4%

- Median price per square foot: $119

- Median days on market: 62 (up 2% since January 2023)

- Rental vacancy rate: 13.2%

- Homeowner vacancy rate: 18.8%

- One-year appreciation rate: -7.1%

- Average rent: $1,297 (up 1% from January 2023)

- Price-to-rent ratio: 10.92

- Most expensive neighborhoods:

| Neighborhood | Average Monthly Rent | Median Listing Price |

| Redmont Park | $1,622 | $1,054,565 |

| Shoal Creek | $2,172 | $640,527 |

| Brook Highland | $2,310 | $563,166 |

| Highland Lakes | $2,445 | $558,936 |

| Veterans Park | $2,086 | $541,803 |

- Least expensive neighborhoods:

| Neighborhood | Median Monthly Rent | Median Listing Price |

| Inglenook | $1,691 | $70,634 |

| Oakwood Place | $1,633 | $77,122 |

| North Birmingham | $1,516 | $81,033 |

| Norwood/ Druid Hills | $1,216 | $84,086 |

| Collegeville | $1,187 | $46,160 |

Final Thoughts: Birmingham Real Estate Market in January, 2024

The Birmingham real estate market is constantly changing and evolving. But the potential for investors to profit is near-constant. Whether you’re an experienced real estate investor or brand new to the industry, the Birmingham real estate market could provide ample opportunity to build your portfolio.

Get Started Buying Homes With Evernest

Whether you’re purchasing one Birmingham home or one hundred, you don’t have to go it alone. If you’re ready to buy your first (or next) investment property, here are three steps to get started today:

- Subscribe to our podcast: The Evernest Real Estate Investor Podcast—for all things real estate investing, being a landlord, growing your portfolio, and more.

- Find a property: Make sure you sign up for our Pocket Listings to get notified of all the deals that come across our desk daily.

- Get an investor-friendly agent: We can help with that—we would love to help you buy your next rental property investment.